Auto Loan: Loan EMI Calculator

All trademarks belong to their respective owners.

| Update : 2024-09-30 | Developer : Campingg Studio |

| OS : IOS/ Android | Category : App |

Auto Loans: Understanding the Auto Loan EMI Calculator

The Auto Loan: Loan EMI Calculator app, developed by Campingg Studio, is a highly efficient tool designed to simplify the process of calculating monthly payments for auto loans. With a focus on accuracy and ease of use, this app has quickly become a favorite among millions of users around the world. Let’s explore why this app is such a valuable resource:

User-Friendly Interface

The app features a clean, intuitive design that allows users to navigate through the loan calculation process effortlessly. Whether you're a first-time car buyer or an experienced financial professional, the interface is built to be easy to understand, even for those with limited financial knowledge.

Advanced Calculation Features

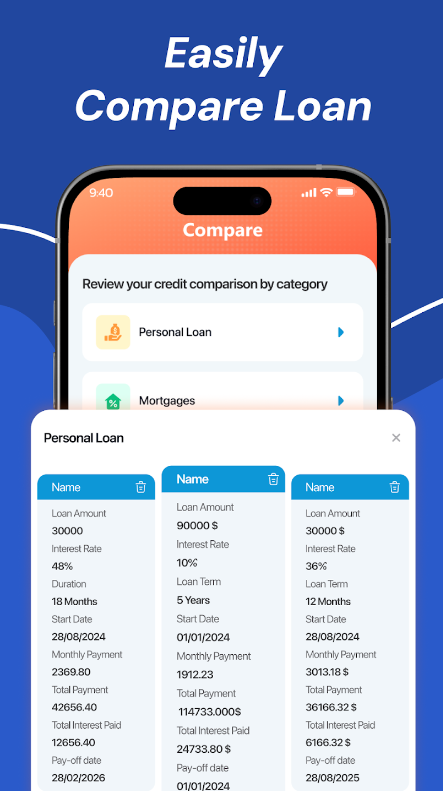

The Auto Loan EMI Calculator goes beyond basic calculations. It provides detailed insights into how your monthly payments are structured, including a breakdown of principal and interest amounts. You can adjust variables like loan amount, interest rate, and loan tenure to see how different scenarios affect your payments.

Global Reach and Popularity

With over 50 million users worldwide, the app has gained a strong reputation for its reliability and effectiveness. Its popularity is a testament to its capability to meet diverse needs, whether you’re looking to finance a new car, refinance an existing loan, or simply explore your auto loan options.

Ideal for All Users

The app caters to a wide range of users, from individuals purchasing their first vehicle to financial professionals seeking to provide accurate loan information to clients. It helps users manage their auto loans effectively by offering quick calculations and allowing them to make well-informed decisions on the go.

Accurate and Reliable

The core strength of this app lies in its ability to provide precise calculations for your auto loan EMIs. This accuracy helps users plan their finances better, avoid surprises, and ensure they can comfortably manage their car payments without straining their budget.

Whether you're in the market for a new vehicle or just looking to get a handle on your existing auto loan, the Auto Loan: Loan EMI Calculator app by Campingg Studio is an indispensable tool that brings clarity and control to your financial planning. Its smart features and adaptability make it a go-to choice for anyone serious about managing their auto loan with confidence.

Advertisement

How the Auto Loan: Loan EMI Calculator App Works

Comprehensive Guide to Using a Loan Calculator: How It Simplifies Your Financial Planning

In today's fast-paced world, planning for personal and business expenses can be overwhelming without the right tools. Whether you're considering a new car, expanding your business, or buying a home, understanding your loan payments is crucial. That's where a Loan Calculator becomes your most reliable companion. In this article, we'll dive deep into how loan calculators work, why they are essential, and how you can use them to make informed financial decisions.

What is a Loan Calculator?

A loan calculator is a digital tool designed to help you estimate your monthly payments, interest rates, and the total cost of a loan. It can be used for various types of loans, including personal loans, auto loans, home mortgages, and business loans. By simply entering the loan amount, interest rate, and repayment period, the calculator provides you with a detailed breakdown of your expected monthly payments.

Why Use a Loan Calculator?

- Accurate Estimates: Provides precise calculations for your monthly payments and total loan cost.

- Saves Time: Speeds up the loan evaluation process, so you don’t need to manually crunch numbers.

- Reduces Errors: Minimizes the chance of calculation errors, ensuring you make well-informed decisions.

- Informed Decision-Making: Helps you compare different loan options to choose the most cost-effective one.

How to Use an Auto Loan Calculator

Planning to buy a car? An auto loan calculator is the perfect tool to help you estimate your car payments. By entering details like the loan amount, interest rate, and term, you can quickly find out how much your monthly payments will be.

Step-by-Step Guide to Using an Auto Loan Calculator

- Enter the Loan Amount: This is the total amount you plan to borrow to purchase the vehicle.

- Interest Rate: Input the interest rate offered by the lender.

- Loan Term: Select the duration of the loan in months or years.

- Down Payment: Include the amount you will pay upfront if applicable.

- Calculate: Click on the calculate button to get an accurate estimate of your monthly payments.

Understanding the Mortgage Loan Calculator

Purchasing a home is a significant financial commitment, and a mortgage loan calculator can make the process easier to navigate. This tool allows you to calculate monthly mortgage payments based on the loan amount, interest rate, and repayment term.

Benefits of a Mortgage Loan Calculator

- Customized Payment Plans: Explore different payment scenarios to find the best mortgage plan.

- Interest Cost Analysis: Understand how much interest you will pay over the life of the loan.

- Early Payoff Strategies: See how making extra payments can reduce your interest costs and loan term.

Exploring the Business Loan Calculator

If you're looking to expand your business, a business loan calculator can be an invaluable tool. It helps you estimate the costs associated with borrowing, so you can plan your financial strategy accordingly.

Features of a Business Loan Calculator

- Flexible Loan Terms: Adjust the loan term to see how it impacts your monthly payments.

- Interest Rate Calculations: Quickly compute how different interest rates affect your loan.

- Comparative Analysis: Evaluate multiple loan offers to find the best financing solution for your business.

The Versatility of an EMI Loan Calculator

An EMI (Equated Monthly Installment) loan calculator is versatile and can be used for various loan types. Whether you're planning for a personal loan, auto loan, or mortgage, this tool helps you calculate your monthly payments with ease.

How Does an EMI Loan Calculator Work?

The EMI calculation formula used in most calculators is:

EMI = [P × R × (1 + R)^N] / [(1 + R)^N - 1]Where:

P = Principal Loan Amount

R = Monthly Interest Rate

N = Number of Monthly Installments

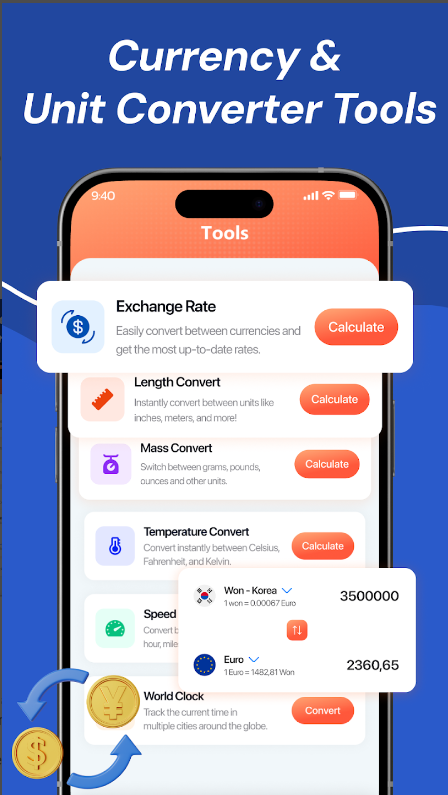

Additional Tools: Exchange Rate and Unit Converter

Many loan calculator apps also include extra tools like an exchange rate converter and a unit converter. These features can be particularly useful when you're dealing with loans or investments in foreign currencies.

Exchange Rate Converter

- Real-Time Rates: Access up-to-date exchange rates for multiple currencies.

- Global Transactions: Simplify international loan calculations by converting currencies instantly.

- Accurate Conversions: Ensure you make precise financial decisions when dealing with global finances.

Unit Converter

- Versatile Conversions: Convert units of length, speed, time, and more.

- Comprehensive: Useful for various calculations beyond just financial ones.

Common Mistakes to Avoid When Using a Loan Calculator

- Incorrect Interest Rate Entry: Always ensure you enter the annual interest rate correctly.

- Ignoring Additional Fees: Some loans come with processing fees or hidden charges that can affect your total loan cost.

- Not Considering Early Repayments: If you plan to make extra payments, factor them into your calculations for a more accurate picture.

- Short-Term vs. Long-Term Loans: Understanding the impact of loan tenure on your overall interest cost is crucial for choosing the right option.

Frequently Asked Questions About Loan Calculators

- Can I use a loan calculator for any type of loan? Yes, most loan calculators are versatile and can handle calculations for various types of loans, including personal loans, mortgages, auto loans, and business loans.

- How accurate are loan calculators? Loan calculators provide highly accurate estimates as long as you input the correct information.

- Can a loan calculator help me save money? Absolutely! Using a loan calculator, you can explore different loan scenarios to choose the most cost-effective one.

- Are there mobile apps available for loan calculations? Yes, numerous mobile apps offer loan calculation features along with currency converters and financial tips.

Conclusion

A Loan Calculator is more than just a tool; it’s a financial advisor that guides you through the complexities of loan management. Whether you're planning to purchase a car, buy a house, or expand your business, this tool can help you make the best financial decisions. It provides accurate estimates, saves time, reduces errors, and ensures you’re well-informed before making any commitments.

If you're ready to take control of your finances, start using a loan calculator today. Make smarter financial decisions and pave the way for a secure future.